NPS Survey: Would you recommend Dave – Banking & Cash Advance

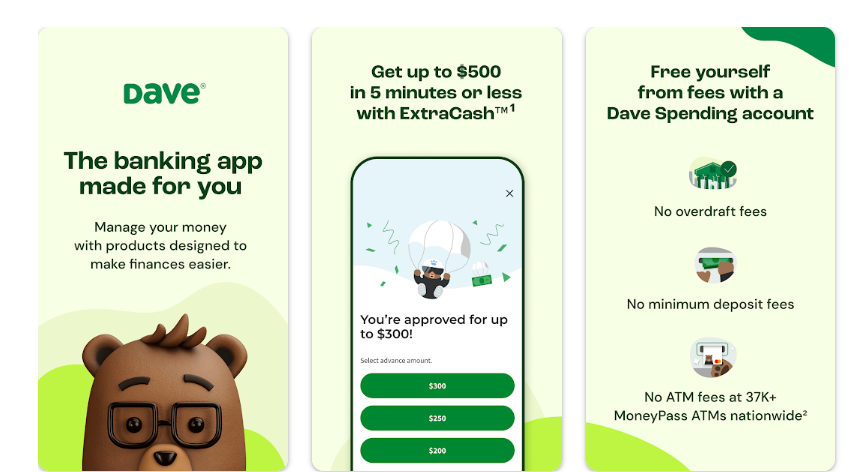

Allow me to introduce you to Dave, a personal finance application renowned for its innovative ExtraCash™ feature, enabling users to secure short-term loans of up to a generous $500. The remarkable aspect of this feature is its absence of mandatory fees, though users do have the option to leave a discretionary tip as a token of appreciation.

Moreover, Dave extends its services to encompass a banking facility that boasts an enticing proposition: no overdraft fees and no oppressive minimum balance requirements. A cherry on top is the ability for users to make free ATM withdrawals from a vast network spanning 32,000 locations.

Now, let’s delve into the pros and cons of the Dave app:

Pros:

- No Interest: Dave wears the crown of benevolence, with a policy of charging zero interest on its loans.

- Offers Insightful Side Hustle Suggestions: In its quest to empower users financially, Dave goes the extra mile by providing valuable advice on discovering side hustles to augment one’s income.

- Guardian of Balances: Dave plays the role of a vigilant protector, sending timely balance updates to shield you from the menacing specter of overdrafts.

Cons:

- Membership Costs: To access the coveted cash advances, users must be willing to part with a mere dollar each month, making it the most affordable membership fee in the financial app universe.

- Brief Repayment Terms: Dave’s repayment terms are concise, aligning with the expectation that users settle their debts by their upcoming payday.

Who the Dave App Is Best For:

The Dave app finds its perfect niche among those seeking short-term financial assistance, all the while harboring a desire to escape the clutches of the exorbitant fees that traditional payday lenders impose. The hallmark feature of optional tipping grants users unparalleled freedom in choosing their contribution, fostering a sense of financial empowerment and flexibility.

Who the Dave App Isn’t Right For:

It’s important to note that Dave typically mandates borrowers to repay their loans on their impending payday. This rapid turnaround might not align with the preferences of every consumer. If you’re in pursuit of a more extended repayment plan, traditional personal loans or credit cards might be better-suited options for your financial journey.

Dave App Details:

Eligibility: Dave makes financial inclusivity a reality by forgoing the need for a credit check. However, the quantum of funds you can access hinges on various factors, including your monthly income. Keep in mind that your eligibility may evolve daily, so it’s wise to revisit the app if your initial request falls short of your needs.

Withdrawals: While the coveted ExtraCash™ feature might not be universally accessible, Dave simplifies the process. Start by linking your bank account, then navigate to the Dave app to ascertain your eligibility for an ExtraCash™ advance. Depending on your situation, you may be required to provide additional information to complete the withdrawal process.

Interest and Fees: Here’s where Dave truly stands apart. It boldly proclaims a total absence of interest charges. Yet, it does levy a fee based on the type of transfer you opt for. Express transfers to a Dave account fall within a range of 99 cents to $6.99, while external account transfers will set you back between $2.99 and $11.99. The specific fee is contingent on the amount requested, with standard transfers incurring no extra cost. Furthermore, Dave users are bestowed with the liberty to leave a tip, although it remains entirely at their discretion. The ExtraCash™ feature, in essence, serves as an economical alternative to the conventional payday loan, making it a standout choice.

How the Dave App Works:

At the heart of Dave’s appeal lies the ExtraCash™ option, where users can secure loans of up to a substantial $500, all without the need for a credit check or the burden of interest charges. Dave simplifies the repayment process by automatically debiting the owed amount from your bank account on your forthcoming payday or the nearest Friday following your loan acquisition. In the event of insufficient funds, Dave will tactfully deduct partial amounts until the debt is fully settled.

When it comes to fund withdrawal via ExtraCash™, you’re presented with the flexibility to transfer the funds either to your Dave Spending bank account or to an external account. Dave takes pride in offering both express and standard transfer options. Express transfers guarantee swift delivery, with funds reaching a Dave account within seconds and external accounts within an hour.

In conclusion, the Dave app emerges as a beacon of financial empowerment, offering a multifaceted solution for those seeking short-term financial support. Its commitment to minimal fees, optional tipping, and the absence of interest make it a compelling choice for those eager to take control of their financial journey. Whether you’re in need of a quick cash infusion or prudent financial advice, Dave has you covered.

NPS SURVEY

powered by Advanced iFrame. Get the Pro version on CodeCanyon.

NPS Survey Result

powered by Advanced iFrame. Get the Pro version on CodeCanyon.

ABOUT NPS Survey

NPS surveys divide your users into three categories based on the scale point they selected:

1) Promoters (9-10): Promoters are your customers who are loyal and enthusiastic about your organization and will continue buying and referring others.

2) Passives (7-8): Passives are generally satisfied customers, but lack the enthusiasm of Promoters. This group is vulnerable to competitive offerings and not immune to defection.

3) Detractors (0-6): Detractors are often unhappy and can diminish your brand through negative word of mouth.

Disclaimer: This Survey is an Independent Review

Please note that this survey is conducted as an independent review and is not affiliated with any particular company or organization. The opinions and views expressed in this survey are solely those of the participants and do not represent the official stance or perspective of any company. The purpose of this survey is to gather unbiased feedback and insights from respondents. Thank you for your participation.